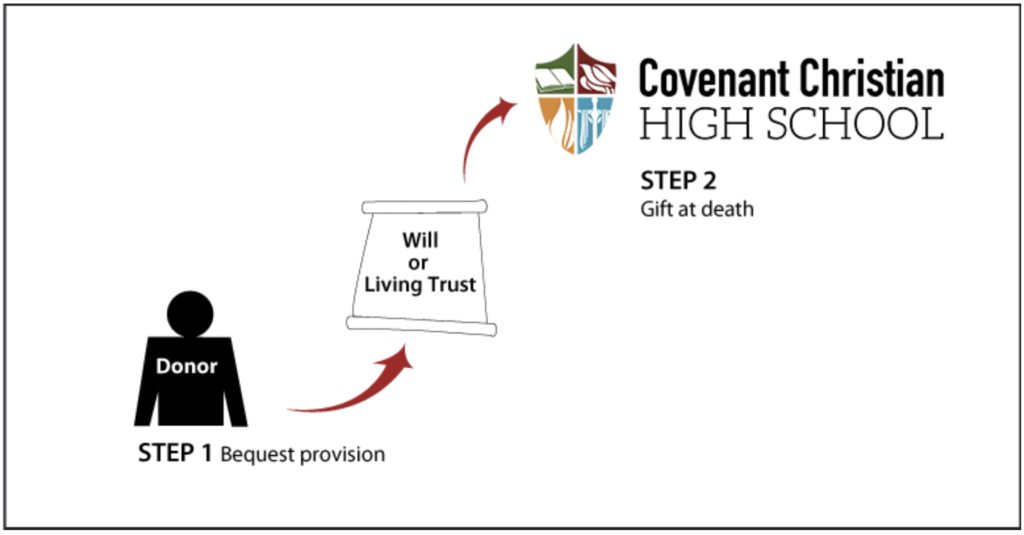

How It Works

- You include a bequest provision in your will or revocable trust

- At your death Covenant receives the bequest you specified

Benefits

- You may change your bequest or trust designation at any time

- You control the funding property during your lifetime

- Your bequest or trust designation will not be subject to any potential federal estate tax

- You provide future support for Covenant

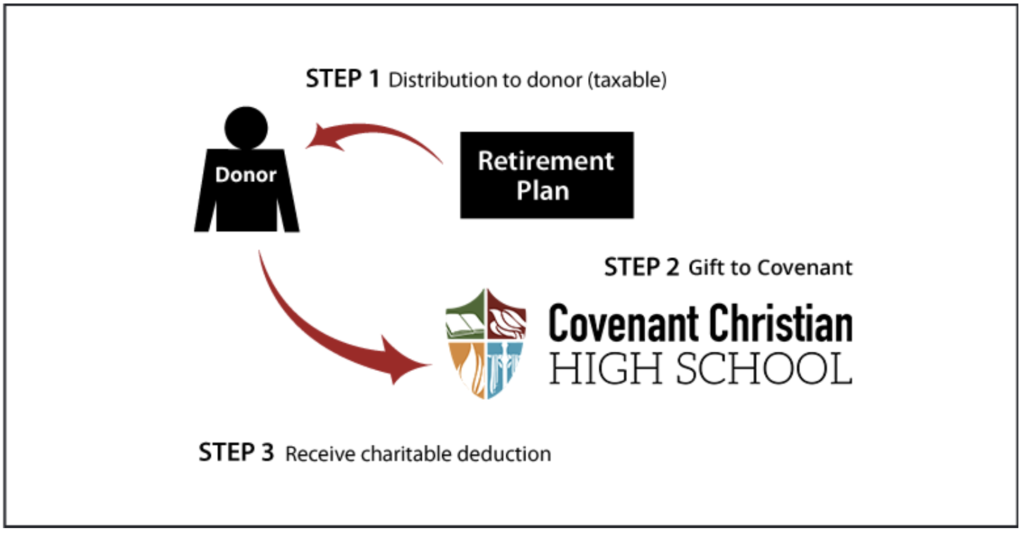

How It Works

- You take a distribution from your qualified retirement plan or IRA that is includable in your gross income

- You make a gift of the distribution or of other assets equal in value to the distribution

- You receive an offsetting charitable deduction

- If you are 70½ or older, learn about the IRA rollover opportunity available to you

Benefits

- You may draw on perhaps your largest source of assets to support the programs that are important to you at Covenant

- The distribution offsets your minimum required distribution

- If you use appreciated securities instead of cash from your distribution to make your gift, you’ll avoid the capital-gain tax on the appreciation

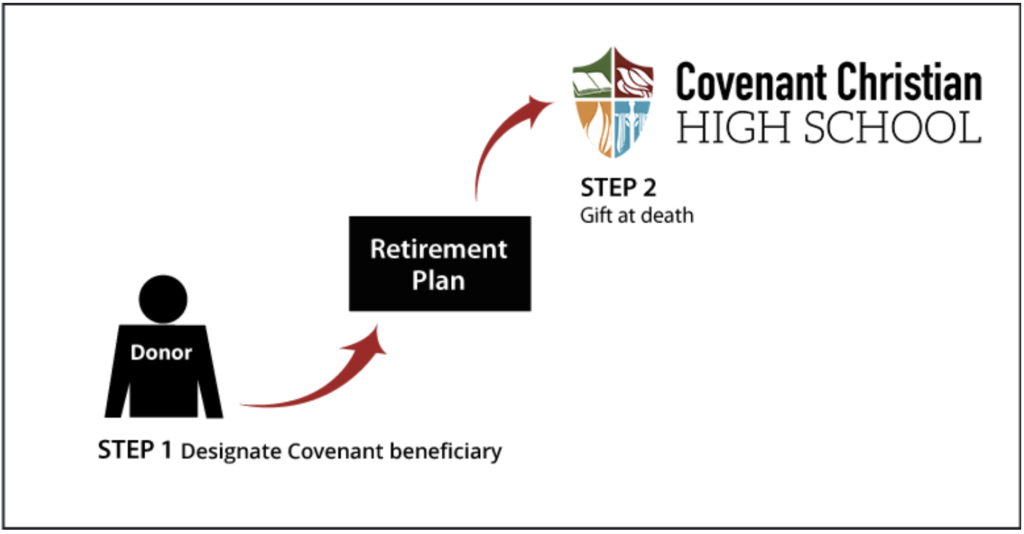

How It Works

- You name Covenant as beneficiary for part or all of your retirement-plan benefits

- Funds are transferred by plan administrator at your death

Benefits

- No federal income tax is due on the funds that pass to Covenant

- No federal estate tax on the funds

- You make a significant gift for the programs you support at Covenant

Special note: Call or e-mail us to tell us of your intent, and we will assist you with the details of the transfer.

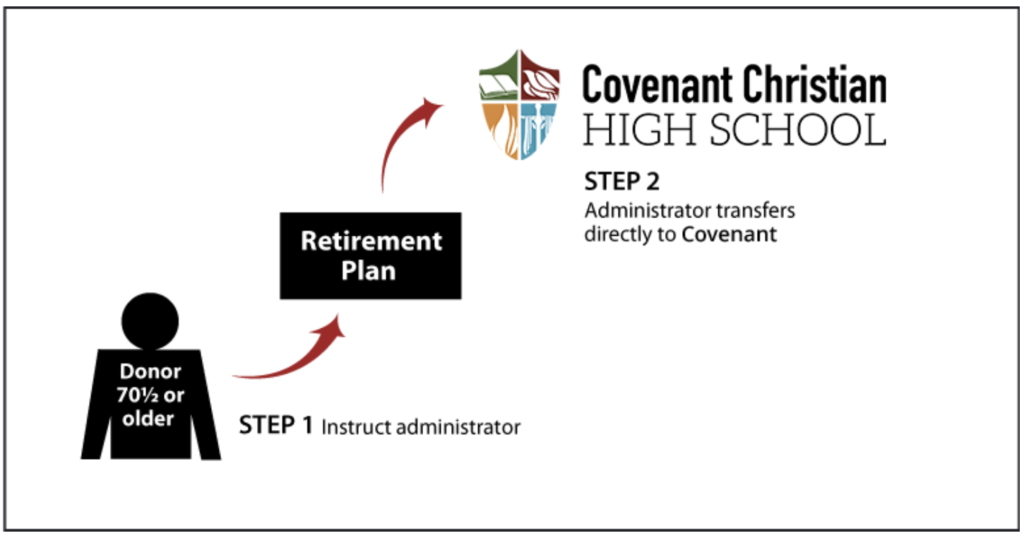

How It Works

- You are 70½ or older and instruct your plan administrator to make direct transfers to us and any other charities that, cumulatively, do not exceed $100,000 in the case of outright gifts or $50,000 in the case of transfers for a life-income plan. Both of these limits are adjusted for inflation beginning in 2024.

- Plan administrator makes transfer as directed to Covenant

Benefits

- Your gift is transferred directly to Covenant; since you do not receive the funds, they are not included in your gross income*

- The amount you transfer will count towards your mandatory distribution if you have attained the age when required distributions begin. That age, which had been 72, was raised to 73 for those who become 72 between January 1, 2023, and December 1, 2032, and 75 for those who reach the age of 74 after December 31, 2032.

- You support the programs that are important to you at Covenant

*No income-tax deduction is allowed for the transfer.

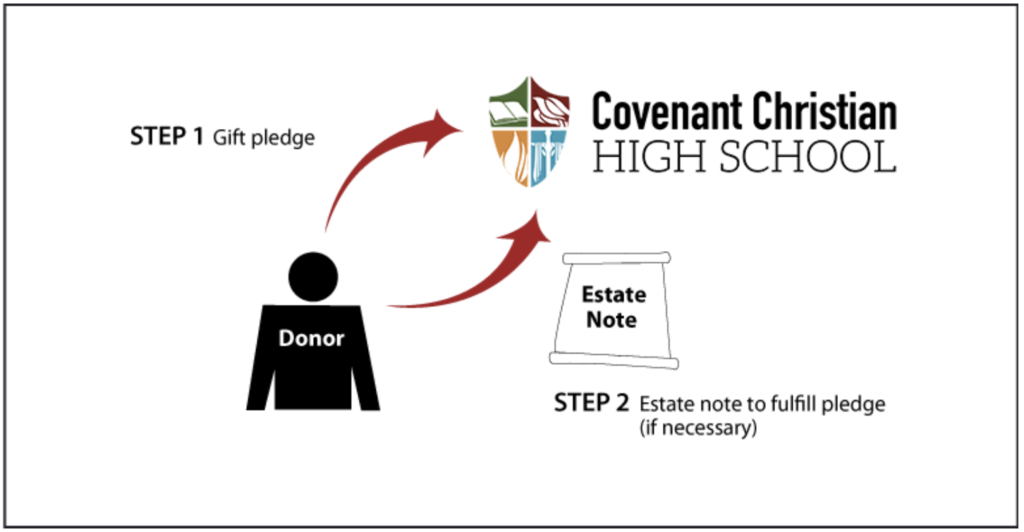

How It Works

- You make a pledge of support to Covenant

- You execute an estate note to pay off pledge from estate assets in case pledge remains unpaid at death

Benefit

- You are assured that the programs you wish to support at Covenant will receive all the funds you intend

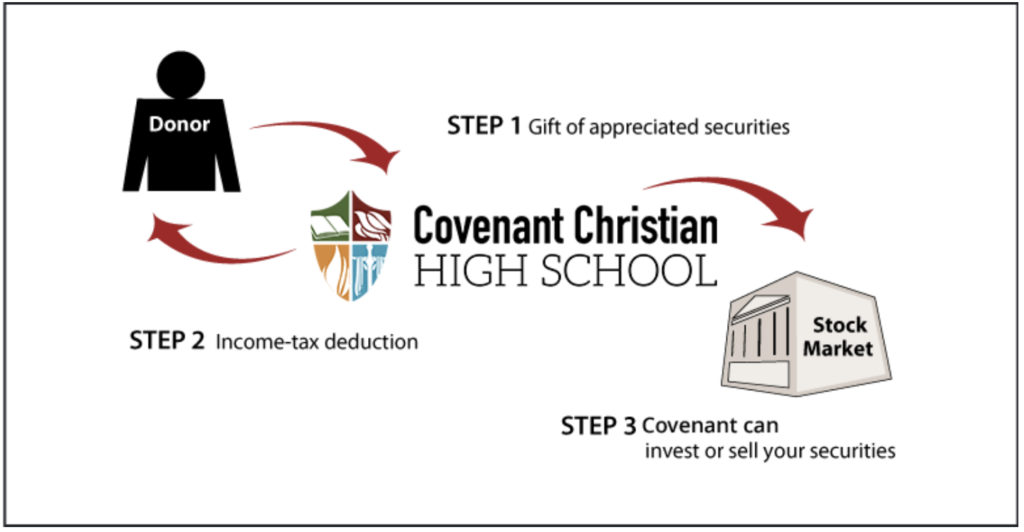

How It Works

- You can send unendorsed stock certificates by registered mail or instruct your broker to make the transfer from your account to our account

- You receive an income-tax deduction

- Covenant may keep or sell the securities

Benefits

- You receive a federal income-tax deduction for the full fair-market value of the securities

- You avoid long-term capital-gain tax on any appreciation in the value of the stock

- Your gift will support Covenant as you designate

Special note: You should call or e-mail us to tell us of your intent, and we will be able to assist you with the details of the transfer.

An important but frequently overlooked role of life insurance is the one it can play in charitable gift planning. Life insurance itself can be the direct funding medium for a gift, permitting the donor to make a substantial gift (face value of policy) for a relatively modest annual outlay (i.e., the premium payment).

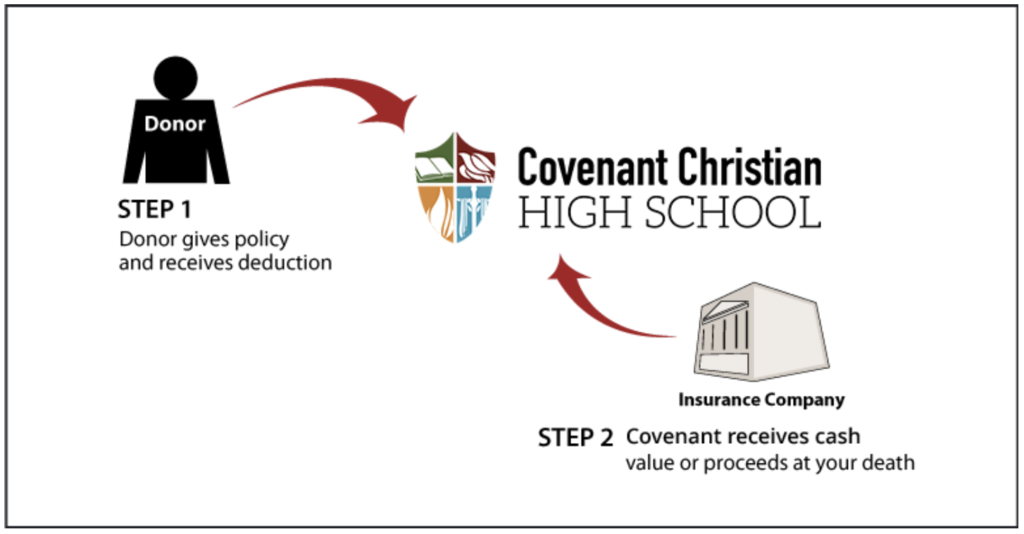

How It Works

- You assign all the rights in your insurance policy to Covenant, designate us as irrevocable beneficiary, and then receive an income-tax deduction

- Covenant may surrender the policy for its cash value or hold it and receive the proceeds at your death

Benefits

- You receive a federal income-tax deduction

- If premiums remain to be paid, you can receive income-tax deductions for contributions to Covenant to pay these premiums

- You can make a substantial gift on the installment plan

- Covenant receives a gift they can use now or hold for the future

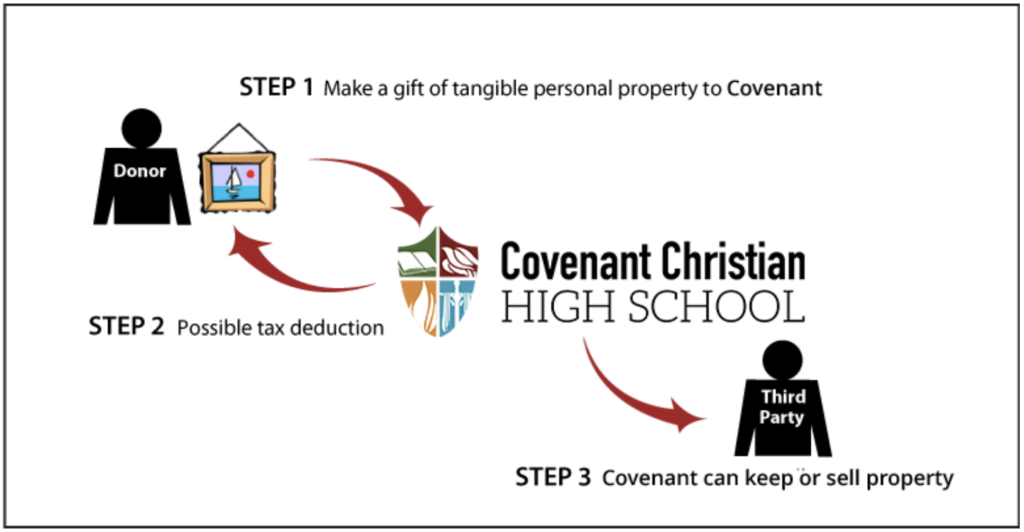

How It Works

- Please call us to discuss the type of tangible property, possible uses of your gift by Covenant, and getting an appraisal

- You receive a charitable income-tax deduction for the full fair-market value of the property if the gift’s use is related to Covenant’s exempt purposes

- If the use is unrelated to our exempt purposes or if it’s understood that we will be selling the property, then the deduction is limited to your cost basis

Benefits

- You receive a federal income-tax deduction for the fair-market value if the gift’s use is related to Covenant’s charitable purposes

- You avoid capital-gain tax on long-term related-use property (capital-gain tax on tangible personal property is 28%)

- You provide significant support for Covenant without affecting your income

Special note: You should call or e-mail us to tell us of your intent with regards to the property, and we will be able to assist you with the details of the transfer.

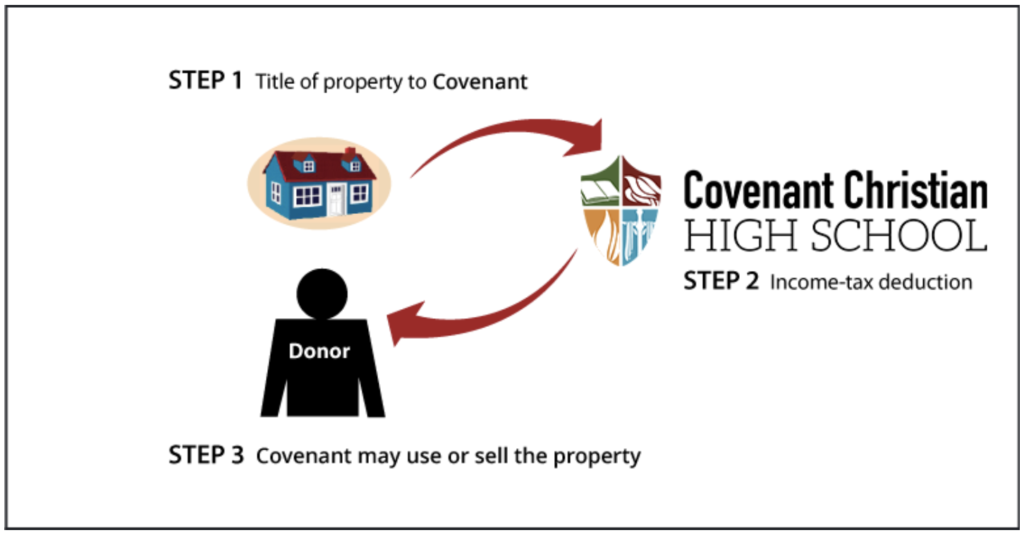

How It Works

- Transfer title of property to Covenant

- Receive income-tax deduction for fair-market value of property

- Covenant may use or sell the property

Benefits

- Income-tax deduction for fair-market value of property based on qualified appraisal

- Avoid capital-gain tax on appreciation in value of the real estate

- Relieved of details of selling property

- Significant gift to Covenant

Disclaimer

The discussion herein is general in nature and may not apply to all individuals. Prospective donors are urged to consult their personal tax and financial advisors concerning the specific consequences of making gifts to Covenant. We would be pleased to discuss, in confidence, ways in which you may support Covenant. These measures may also have an impact on your estate planning.